Homeowner Services

Real Solar Incentives

maximizes IRS Solar benefits

By lowering the Net Cost solar projects RSI make owning solar more affordable and practical. RSI uses Residential Solar Depreciation to significantly reduce net costs.

If you use the Solar Net Cost Calculator below you can get an estimate of your expected Net Cost after all your incentives are factored in. Enter your marginal tax rate (22%<$102K, 24%<$197K, 32%<$250K, and 35%<$626K. Your local solar designer should give you your estimate for your state, municipal, and utility incentives.

Some states have SREC (Solar Renewable Energy Credit) programs that often pay out very generously. Your state may have one like New Jersey, that pays it out over 15 years. Or, like Illinois, that fully pays it out after about 18 months. Your local designer should know, and and help you in getting them, if they are available to you.

Solar Net Cost Calculator

| Residential Solar Incentives Calculator Calculate Your Solar Incentives |

|||

|---|---|---|---|

| Contract Amount* | |||

| Marginal Tax Rate(%) | |||

| 30% Solar Tax Credit | IRS Rebate everyone gets | ||

| State SRECs Rebate* | * SRECs - Consult your designer. | ||

| State DG Rebate** | ** DG Rebate - Consult your designer. IL gives $300/kw. | ||

| State Battery Rebate*** | *** Battery Rebate - Consult your designer. IL gives $300/kwh. | ||

| Solar Depreciation Est. | |||

| Estimated Total Incentives | |||

| Estimated Net Cost | |||

| Percent Net Cost(%) | |||

| Call Craig Dillon at 312-912-8140, to get your Residential Solar Incentives | |||

Customer examples:

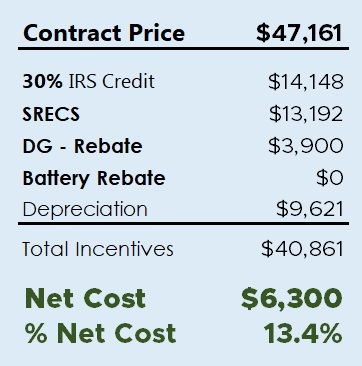

Net Cost < 15%

The generous incentives from Illinois combined with IRS incentives enabled a Net Cost under 15%.

Residential Solar Depreciation combined with Illinois' incentive programs give excellent results. The IL SREC program is fully paid out about 18 months after installation.

In IL, the Distributed Generation incentive gives $300/kw design capacity. A battery incentive is also available.

Consult with your designer to see what state & local incentives are available to you. Then use the calculator above to see an estimate of what your Net Cost will be.

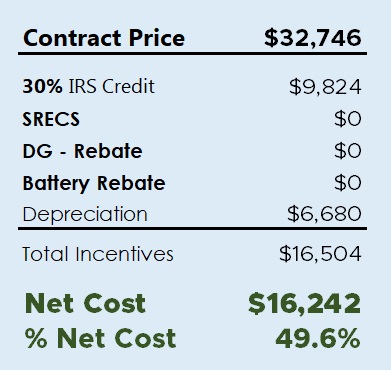

State w/o Incentives,

like TX, MI, MN, & others

Some states have no incentives.

With no state incentives, then a customer still gets the 30% IRS tax credit and the Residential Solar Depreciation. That will bring the Net Cost to around 50%, depending on the customer's marginal tax rate.

The dependability of home solar electricity production and the low grid connection fees makes home solar a practical choice.

Consult your solar system designer about the state and utility incentives available to you. They will be the most familiar with all the local incentives available to you.

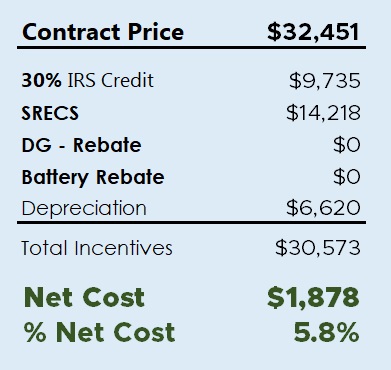

New Jersey - Great SRECs program, payable over 15 years

New Jersey has a great SREC (Solar Renewable Energy Credit) program. It pays out more than most. However, unlike IL, it pays out equal payments over 15 years.

A very low Net Cost can be achieved when combined with Residential Solar Depreciation.

"Saved tons of money. RSI was helpful. They answered all my questions, and made it easy. I have recommended them to my friends.

Scott C.

IL Homeowner

"Easier than I expected. Real Solar Incentives was real knowledgeable and helpful. Saved money.

Brian B.

IL Homeowner

F.A.Q.

If you have another question please email us.

Yes. Depreciation can be claimed by homeowners of solar energy systems when they have a buy-back agreement with their utility. Often called a Net-Metering Agreement, it specifies how the homeowner will be buying & selling electricity to/from the utility every day.

The repeated buying & selling of something of value creates business like transactions, that allow depreciation under IRS rules.

At RSI, we use accelerated depreciation. Our clients get most of their depreciation in the first two years, and all of it after 5 years.

Yes. If you purchase your a residential solar energy system using a loan, then the loan interest and fees are deductible. We help our clients to retrieve those monies. The amounts can be significant.

Yes. Our customer support is available for five years. Accelerated depreciation takes five (5) years to be fully realized. If a client misplaces the documents they receive or forget how to use them, we are available to answer their questions, so they can fill out their taxes correctly.